Get Your Kinsmith Finance Up To $5000

Advantages

Just fill out our smart request form, get connected

with a lender and enjoy your extra cash!

Simple

Our advanced automated system lets you request up to $5,000 by filling out a simple, clear-cut form directly from your computer, tablet, or mobile phone.

Affordable

We don’t focus solely on your credit score. We focus on helping you and providing you with loan offers! So don’t let your credit determine your future and stop you from submitting a request with us!

Fast

The online form usually takes less than 10 minutes to complete. So before you even finish your cup of tea, you’ll already have your request submitted.

Kinsmith Finance Easy Online Process

Installment loans are a convenient and beneficial solution for people dealing with financial difficulties, offering an additional financial source to cover various expenses. These unsecured loans do not require security or collateral and can be taken for up to 24 months and repaid in equal amounts on a monthly basis at fixed interest rates.

To get a small loan, applicants must meet certain requirements, such as having US residency, being 18 years old or more, providing valid contact information, being legally employed, having steady income, having a bank account, and providing any other information enquired by the lender.

It is possible to get small loans for bad credit, as lenders consider a customer’s credit history as less significant than their credit history. The website offers a platform for individuals with poor credit scores to apply for personal loans online, with no penalties for refusal or hidden costs.

The application process is free, and applicants can confirm their needs by providing an e-signature. Loans are usually issued within 24 hours unless holidays, and payments can be made on time. Automatic repayment functions can help avoid missed payments, but delayed payments may result in high fees.

In case of unexpected situations that prevent monthly payments, customers should contact their lender and discuss possible options, such as renewing their loan. Customer support representatives are available to help with any questions or issues related to online personal loans, and an online contact form can be used to reach their support team.

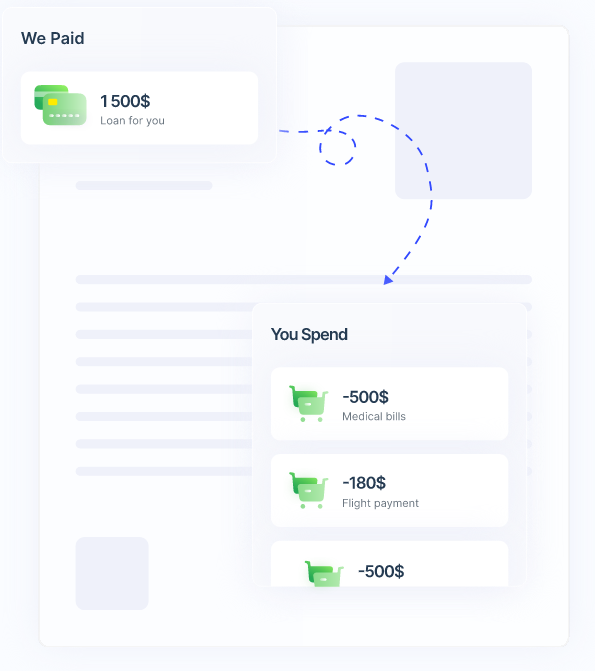

How It Works ?

All paperwork is gone! The whole process is completely online. Just fill in a few details about yourself and hit “Started Now”!

Check The Offers

If the offer suits your needs and desires, and you agree with all the terms — simply e-sign the deal and get ready to enjoy the money!

Receive Your Money

Once you submit your request, get your offer, and e-sign it, you’ll be able to get the funds to your bank account in no time!

Fast. Reliable. Transparent.

We offer free and straightforward services without any hidden fees or charges on our part. And as we care about your comfort and safety, we enable you to submit a request without having to worry about any obligations or threats to your data security.

Already we help 22000+ people get a loan

I can honestly say that this is absolutely the best service I’ve ever tried. Everything is so simple, fast and secure. And you get your results in minutes!

kinsmithafinance.com is not a lender – as such, we do not have control over the APR you will be offered. We display a Representative APR only as it is based on data offered from multiple lenders. The following represents sample rates, is for informational purposes only, and may not reflect the actual APRs offered by your lender or lending partner.

Loan Amount $1,000, Interest Rate 24.00%, Loan Term 12 months, Fee 3.00%, Repayment $94.56, APR 29.82%, Total Repayments $1,134.72, Total Cost $164.72